Politics didn’t make a tasty side dish for beef and cattle markets this week, as various government actions and discussions triggered a selloff.

Two stories drove the narrative. First, as part of its mission to lower beef prices, the Trump Administration announced on Thursday that it was quadrupling the tariff rate quota on beef from Argentina, bringing the threshold to 80,000 metric tons. For context, the US is on pace to import a record 120 million pounds (~54,000 metric tons) of beef from Argentina this year, mostly lean trim. Does going to 80,000 metric tons make a huge difference? Perhaps not, but the news seemed to weaken confidence.

Second, Reuters reported that Mexican Agriculture Minister Julio Berdegue will travel to Washington next week for meetings with US Secretary of Agriculture Brooke Rollins and reopening the US border to cattle from Mexico will be part of the conversation. “We hope he can return with an agreement on the border opening,” Mexican President Claudia Sheinbaum said. Mexican cattle haven’t been allowed in the United States since May 2025 in an effort to prevent the spread of New World Screwworm.

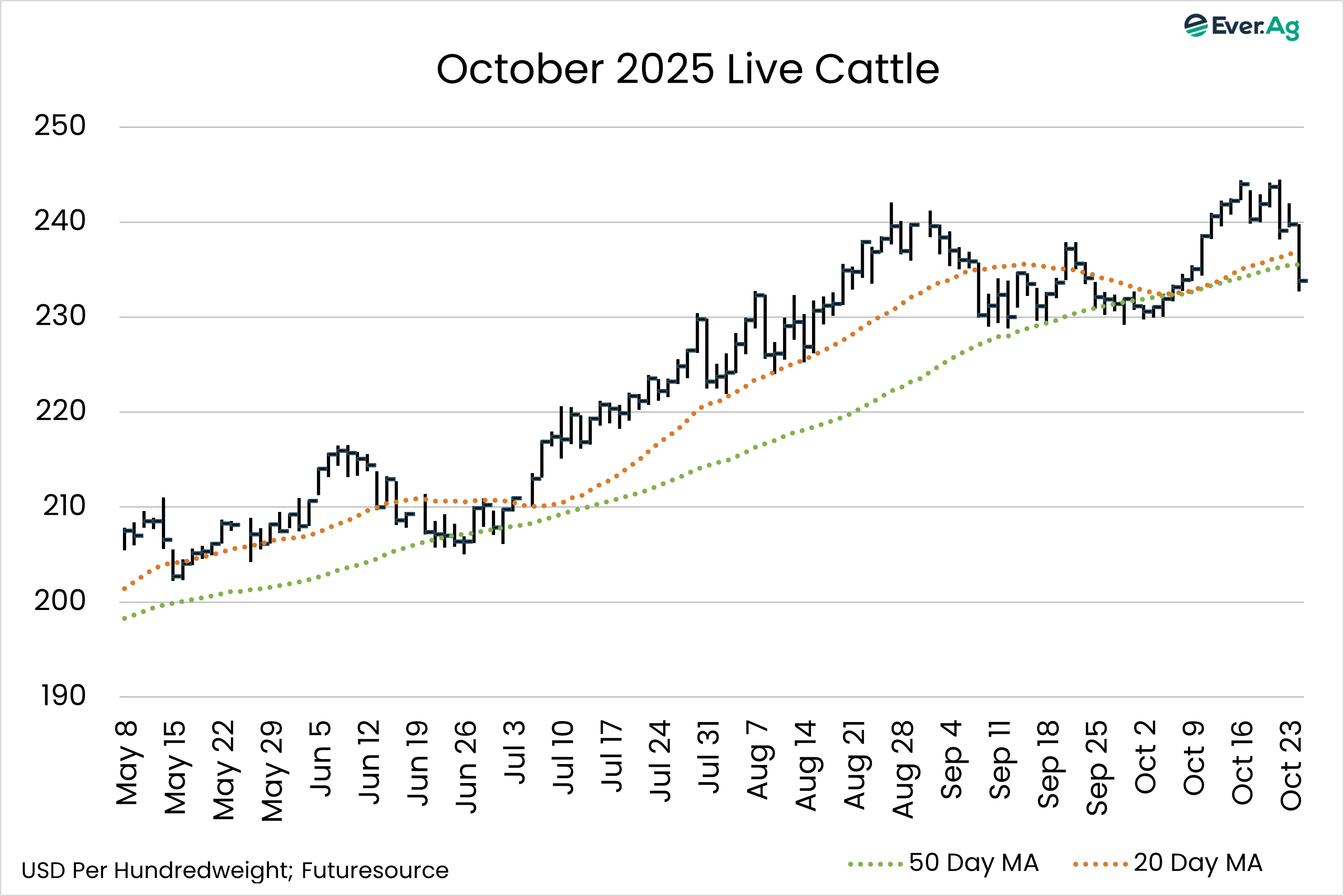

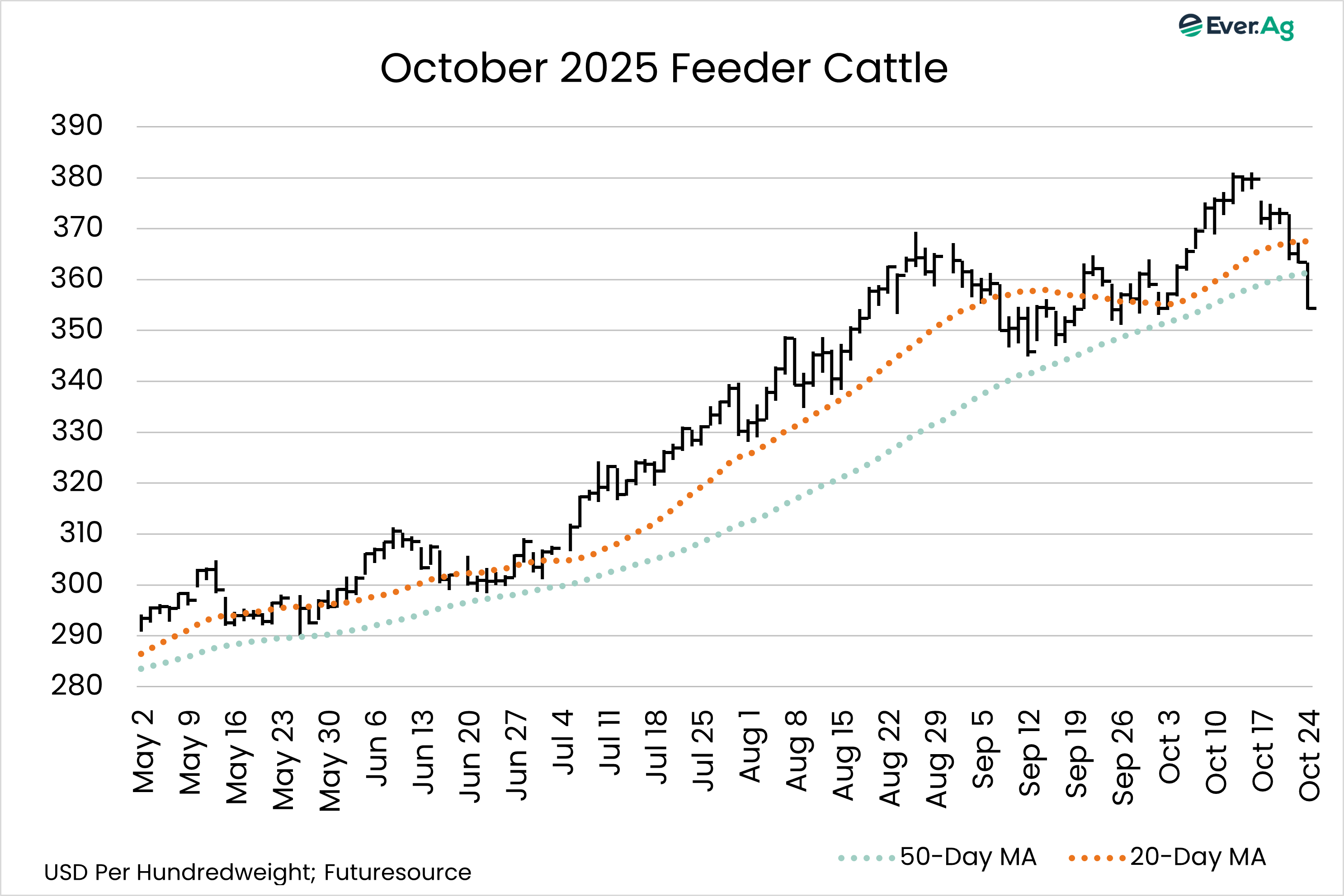

Nearby live cattle futures closed at $233.75 per hundredweight, down 2.7% on the week, while feeders finished at $354.30, down 4.7%.

Cash cattle traded between $235 and $239 per hundredweight in Nebraska, down as much as $5 on the week, and $238 in the south, down about $2.

Analysts estimated cattle slaughter at 573,000 head, up 7,000 from the week prior but down from 625,000 a year ago.

Meat prices moved higher seasonally, with the choice cutout averaging $372.13 per hundredweight, up 1.8%. Select cuts averaged $354.47 per hundredweight, up 1.3%.

As far as retail beef prices go, the US Bureau of Labor Statistics reported that, in September, ground beef at retail averaged $6.32 per pound, unchanged from August but still up 12% year-over-year. All beef steaks averaged $12.26 per pound, up four cents on the month and up 13% year-over-year.

COMMENTARY BY TREY FREEMAN

Beyond the big headlines, the ongoing (and lengthy) stoppage of most government market reports could be driving longs out of the market in sweeping fashion. It seemed as though market longs viewed the few intraday bounces this week as an opportunity to run for the door. The announcement earlier in the week of no monthly Cattle on Feed report (originally scheduled for publication today) was a striking blow. Fund managers obviously don’t like the idea of holding such long exposure through a month with no COF report, especially with prices at record highs.

The administration’s decision to quadruple the TRQ to beef imports from Argentina are less material to the market than suggested by the frenetic downside reaction in the futures markets. This will result in a very minor increase in domestic beef supplies. Does this mean the extreme reaction in futures was largely undeserved? I believe the larger theme that comes to mind with this decision is the fact that the government has a much bigger stick and bigger checkbook than any of us. Therefore, if the Administration wants lower beef prices for the consumer, it can more than likely pull enough strings to make that happen, even if not all at once.

Futures and options on futures trading involve significant risk and are not suitable for every investor. Information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended for informational purposes. Information is obtained from sources believed reliable but is in no way guaranteed. Opinions, market data and recommendations are subject to change at any time. Past results are not indicative of future results. Trey Freeman and Matt Wolf maintain financial interests in the commodity contracts mentioned within this research report at the time it is published. Reproduction or redistribution is prohibited by law. Ever.Ag Insurance Services is an affiliate of Ever.Ag and is a licensed insurance agency in the following states: AZ, CA, CO, CT, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MO, MT, NE, NV, NH, NM, NY, NC, ND, OK, OH, OR, PA, RI, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY. This agency is an equal-opportunity employer.