COMMENTARY BY TREY FREEMAN

Softness persists in US cattle markets.

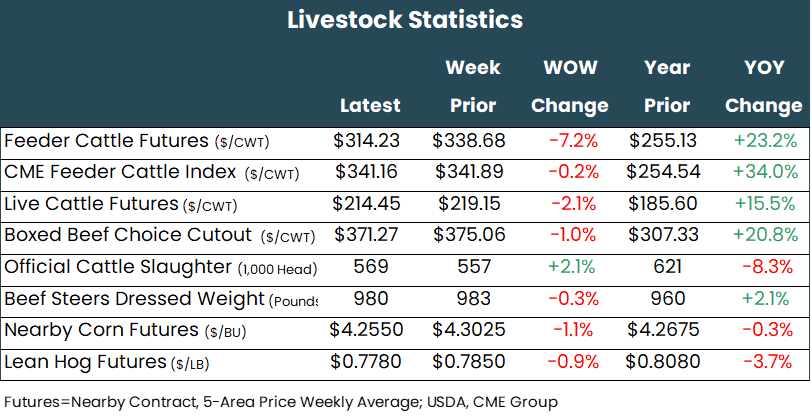

Cash fed cattle on the negotiated market traded $222 to $224 per hundredweight in the South this week, $4 to $5 lower. Trade occurred at $218 per hundredweight in the North, $7 lower. Dressed trade occurred at $340 to $345 per hundredweight, $5 to $10 lower.

This week’s slaughter estimate: 585,000 head, 9,000 more than the week prior and 50,000 less from a year ago.

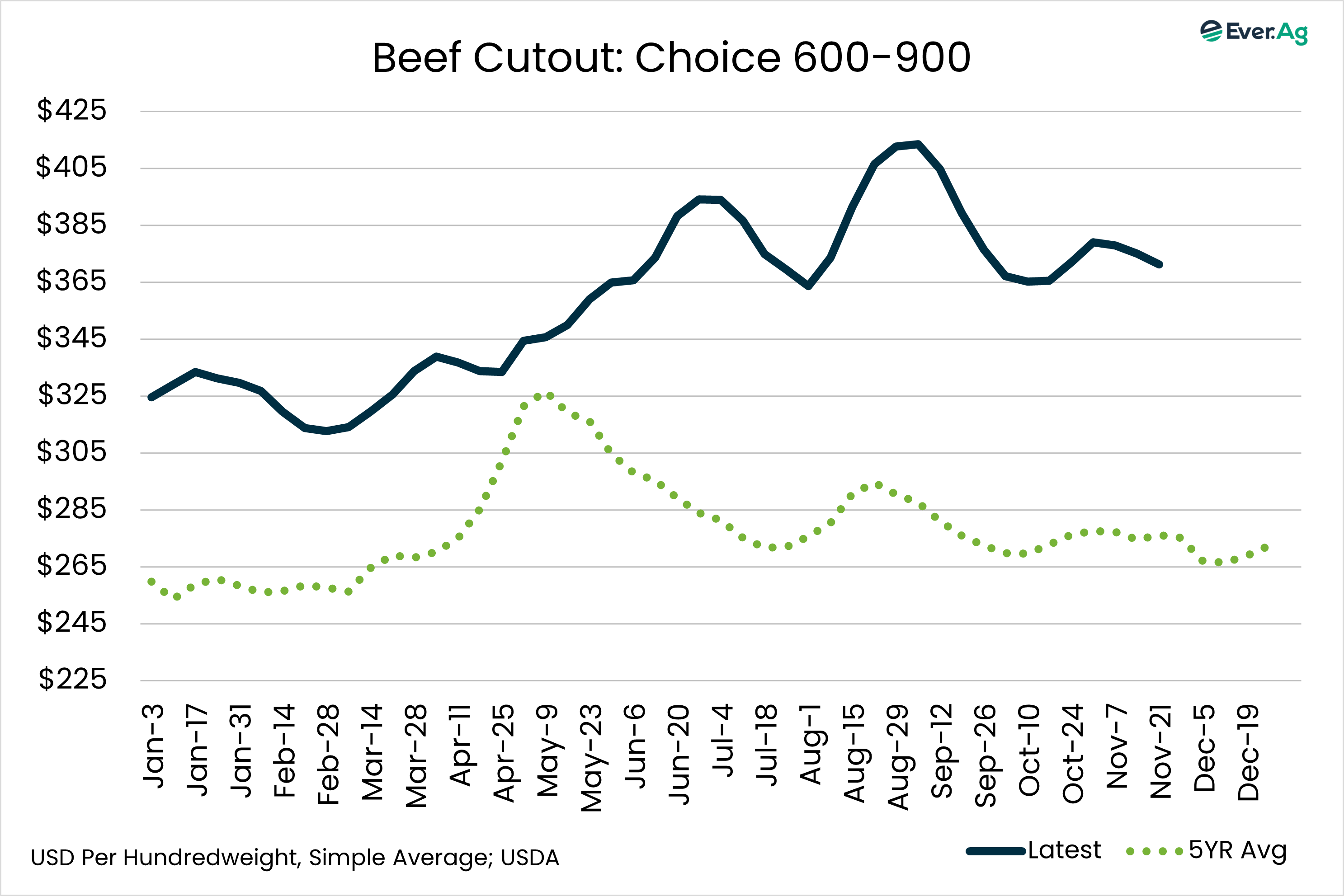

USDA reported the beef choice cutout for the week at an average of $371.27 per hundredweight, down 1.0%.

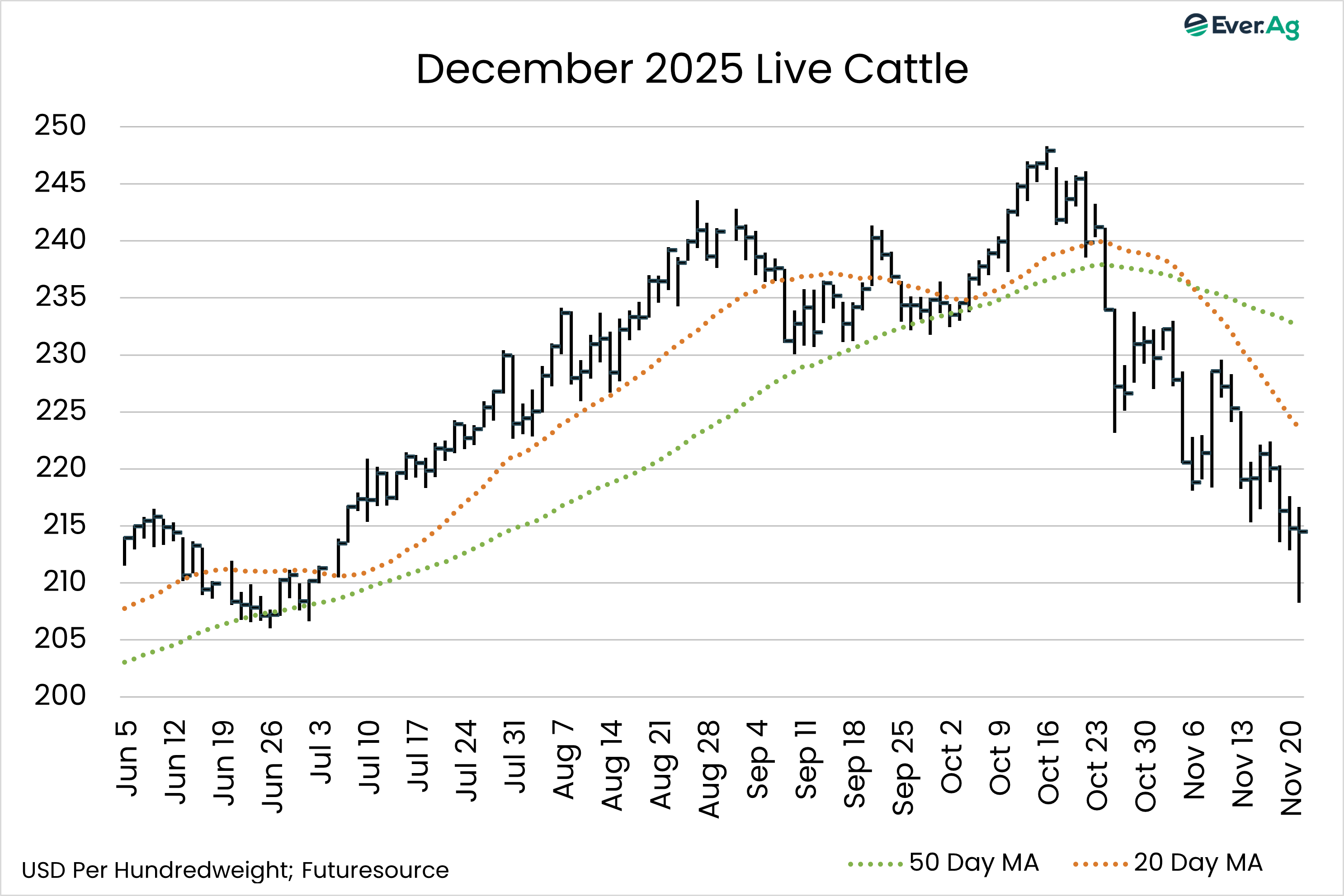

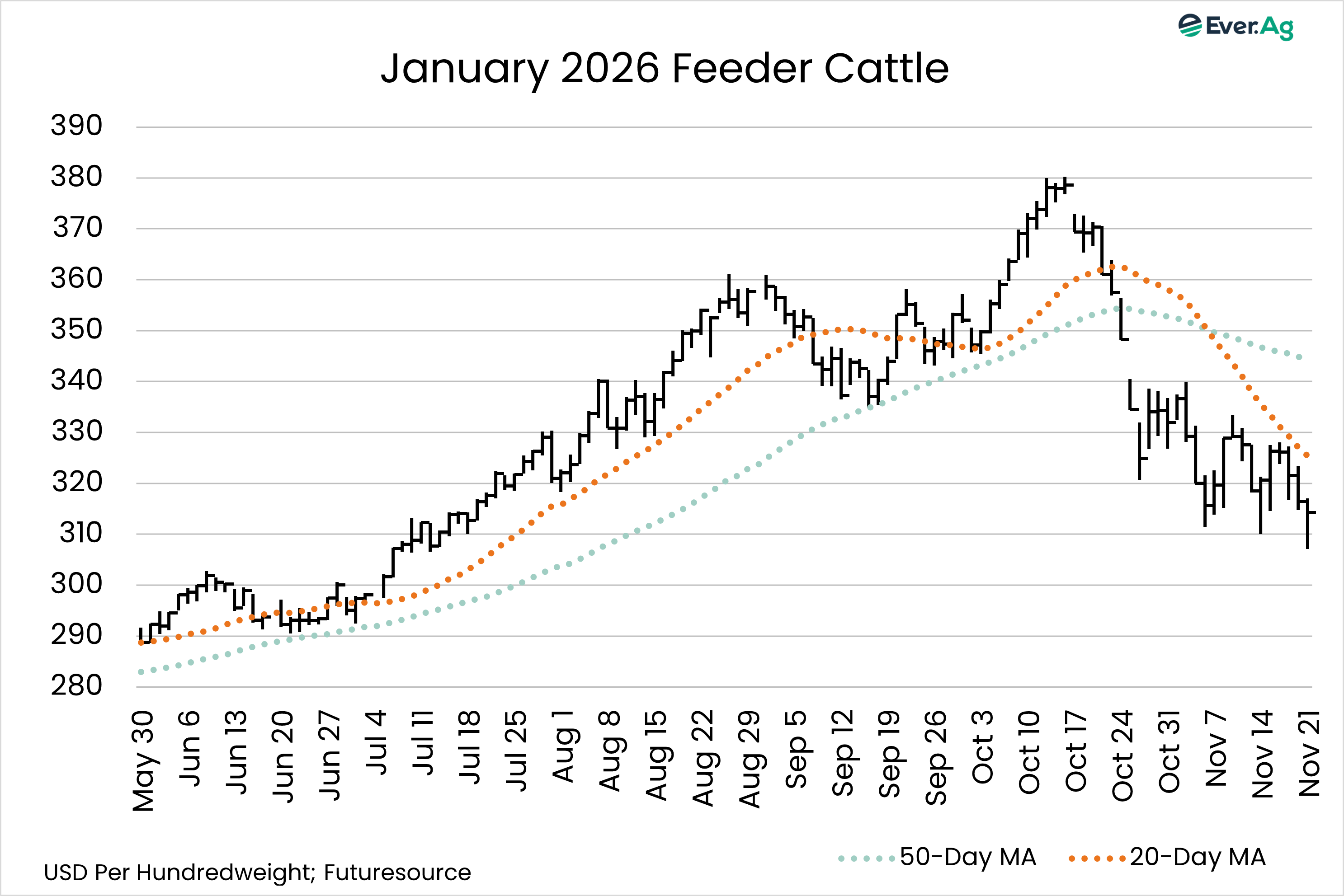

Live cattle futures finished the week down $0.58 to $4.75 per hundredweight, with the greatest losses in the nearby contracts. December settled at $214.45 per hundredweight, down $4.70. Feeder cattle futures finished the week down $3.97 to $6.32 per hundredweight, with the greatest losses also in the nearby contracts. January, now the nearby contract, closed at $314.23 per hundredweight, down $6.32.

Overall, futures continue to sour on prospects of the southern border reopening to feeder cattle from Mexico. In addition, on Thursday evening, President Trump issued an executive order to remove tariffs on Brazilian beef imports into the US. Even though the market expected that measure since last week, futures gapped sharply lower on Friday’s open. Buyers were quick to step in, however, filling the gap and recovering most of the day’s losses.

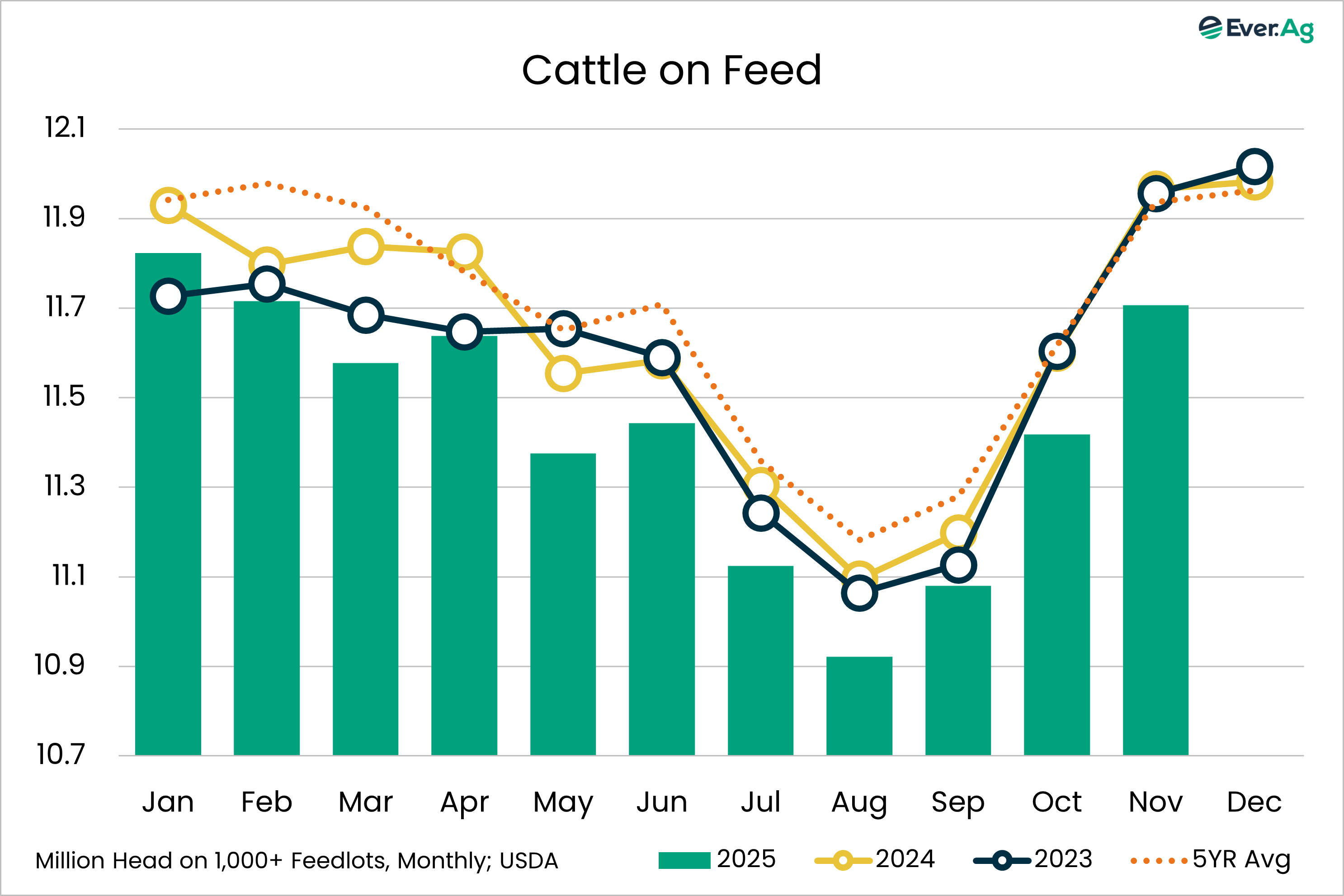

This month’s Cattle on Feed report came in very near analyst expectations. As of November 1, USDA reported 11.706 million head on feed, 97.8% of the year-prior total, close to the consensus call for 97.7%. Placements for October were 90.0% of last year, versus an average guess of 91.6%. October marketings came in at 92.0% versus an average estimate of 92.3%.

Although the Cattle on Feed report offered no surprises, it does confirm that nothing has changed fundamentally in terms of cattle supplies. Buyers in the futures market need persuasion to come off the sidelines, and the updated data may boost confidence in a market that is currently very fragile. However, after the close today, Tyson announced the closure of the Lexington, Nebraska, facility, one of the largest beef processing plants in the state, with a capacity to slaughter up to almost 5,000 head per day. Other reports said that Tyson plans to reduce operations at its Amarillo beef plant located in the Texas Panhandle.

As for the charts, they remain in tough shape. The most actively traded February live cattle contract closed below the 200-day moving average for the first time on Thursday and again on Friday. Today, we saw skirmishes around the psychological support areas of $200 per hundredweight in live cattle and $300 in feeder cattle, with some deferred contracts breaching those levels for a short time.

Futures and options on futures trading involve significant risk and are not suitable for every investor. Information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended for informational purposes. Information is obtained from sources believed reliable but is in no way guaranteed. Opinions, market data and recommendations are subject to change at any time. Past results are not indicative of future results. Trey Freeman and Matt Wolf maintain financial interests in the commodity contracts mentioned within this research report at the time it is published. Reproduction or redistribution is prohibited by law. Ever.Ag Insurance Services is an affiliate of Ever.Ag and is a licensed insurance agency in the following states: AZ, CA, CO, CT, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MO, MT, NE, NV, NH, NM, NY, NC, ND, OK, OH, OR, PA, RI, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY. This agency is an equal-opportunity employer.